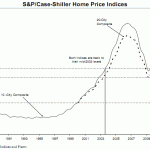

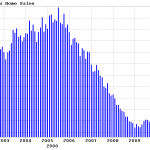

Home prices continue to plunge in value. According to the latest statistics from S&P/Case-Shiller, prices declined by over 1% in October. The crash in housing prices has now brought prices back to levels last seen in 2003. Each local housing market is unique with some states such as Florida and Nevada experiencing much greater price […]

Housing Prices Have Crashed So Much You Can Buy One With A Credit Card

Banking News – Daily Banking Update

Welcome to Banking Update, a roundup of articles and news from around the Internet. The government keeps trying new foreclosure programs despite the failure of previous ones, homeowners past due by more than 60 days are unlikely to recover, home prices continue to drop, mortgage fraud continues and almost half of all home purchases are […]

Mortgage Default Is A Financial Bonanza For Many Homeowners As Foreclosure Crisis Continues

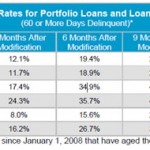

The Office of the Comptroller of the Currency (OCC) painted a gloomy picture for the housing markets with its release of the OCC Mortgage Metrics Report for the third quarter of 2011. Mortgage delinquencies remain at high levels and foreclosures increased by double digits. The OCC report covers mortgages serviced by federal savings associations and […]

Global Financial System Faces Worldwide Bank Runs and Failures, Citigroup’s $300 Billion Problem

Three years after the height of the financial crisis, the issue of impaired assets on bank balance sheets remains a major risk to the health of the banking system. Regulators have allowed banks to avoid taking losses on impaired assets by not requiring mark to market accounting. The extent of overvaluation on bank loans can […]

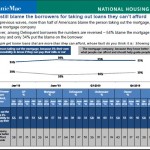

Who Is To Blame For Borrowers Taking Loans They Can’t Afford?

Ever since the mortgage crisis started in 2008, there has been a wide divergence in opinions on who was to blame for borrower defaults. Many blame greedy bankers who abdicated sound underwriting principles for financial gain by approving mortgages for unqualified borrowers. Others blame the borrowers themselves for being irresponsible and taking on debt that […]

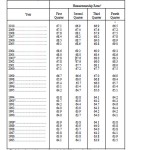

Decade Low On Homeownership Rates Merely A Return To Normalcy

The Census Bureau reports that the level of homeownership has declined to 66.5% for the last quarter of 2010. The number of Americans owning a home is now at the lowest level since 1998 when the rate of ownership was slightly lower at 66.4%. The lower rate of homeownership is not a disaster, as portrayed […]

Housing Market On Critical List As Sales Plunge and Strategic Defaults Loom

The latest news on housing remains distressing and points to continued depreciation in home values. New Home Sales Plunge Again – The Census Bureau and the Department of Housing and Urban Development released figures showing that the number of new homes sold in 2010 totaled only 321,000 – the lowest reading in 47 years. The […]

FDIC Chief Condemns Mortgage Servicers While Ignoring FDIC Role In Mortgage Crisis

In a strongly worded speech at the Summit On Residential Mortgage Servicing For the 21st Century, FDIC Chief Sheila Bair condemned the mortgage servicing industry for their role in extending the mortgage crisis. Ms. Bair stated that the housing industry has been stabilized by emergency measures but that the effects of the housing bust and […]

Impact Of Weak Housing Markets On Economy Overstated

Many analysts believe that the overall economy cannot improve as long as residential housing prices remain weak and/or continue to decline. Schwab’s chief investment strategist, Liz Ann Sonders, who always provides incisive commentary, offers some compelling insights on why a weak housing market will not impede economic growth. In her latest commentary, Ms. Sonders says […]

Court Ruling Against Bank Foreclosures Could Spiral Into Full Blown Financial Crisis

The recent Massachusetts Supreme Court ruling against Wells Fargo and U.S. Bancorp is likely to bring foreclosures to a crawl, resulting in a further destabilizing of housing markets. The Court ruling is a major win for debtors and a severe blow for creditors trying to clear a backlog of millions of defaulted mortgages. The Massachusetts […]