The Consumer Financial Protection Bureau (CFPB) is concerned about the rapidly increasing default rate on mortgages held by senior citizens. A study done by the CFPB shows that the number of senior citizens with mortgage debt has increased, the amount of debt owed has increased, and default rates have risen. According to the CFPB since […]

Mortgage Default Rates Soar for Senior Citizens as Feds Loosen Mortgage Rules for Seniors

Fannie Mae Stock Soars As Mortgage Delinquencies Decline

Fannie Mae’s recently released Monthly Summary reports that serious loan delinquencies decreased slightly in January. A single family home mortgage loan classified as “seriously delinquent” is three or more months past due or in the process of foreclosure. A multifamily mortgage loan is considered seriously delinquent when payments are 60 days or more past due. […]

FHA Loans Immediately Put Borrowers Into A Negative Equity Position

In a speech given at the Brookings Institution, Brian Moynihan, CEO at Bank of America, said “We need to look hard at some of the old assumptions and ask the question is homeownership the right solution for everyone?” Moynihan went on to cite the Federal Housing Administration (FHA) as an example of what is wrong […]

Connecticut Home Values Plunge As Banks Cut Jobs And Bonuses

Banking industry woes are translating into major price declines for high end residential real estate in Connecticut. For those who believe that real estate prices has bottomed out, please consider Connecticut Homes Biggest Losers As Wall Street Cuts. Prices in the Fairfield County area, home of the banker bedroom communities of Greenwich and New Canaan, […]

Congress Moves To Prevent FHA Collapse With “FHA Emergency Solvency Act”

The latest FHA Single-Family Outlook report from the FHA shows that serious delinquencies continue to plague the FHA. The number of seriously delinquent FHA loans increased by 18.9% from last year to a record number of 711,082 mortgage loans. FHA loans classified as seriously delinquent amount to 9.6% of all FHA insured mortgages. A seriously […]

Interest Rates At All Time Lows And Home Prices At Ten Year Lows – Why Are Home Sales The Worst Ever?

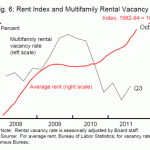

In Federal Reserve Chairman Ben Bernanke’s world, all he had to do was lower interest rates enough and housing prices would magically re-inflate. Wrong! Mortgage rates are at all time lows, home prices are at 2002 levels and owning a home is just as cheap as renting, yet the housing market remains mired in a […]

Foreclosure Inventory Near Record Highs, Attempts To Slow Foreclosures Is Prolonging The Housing Crisis

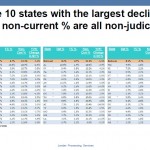

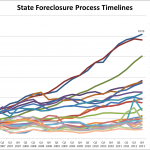

LPS Mortgage Monitor has come out with a comprehensive series of charts including the current level of foreclosures, delinquencies by year of origination, length of time homeowners have not made a payment in judicial states, states with largest drops in non-current mortgages and foreclosure rates in judicial vs non judicial states. The states with the […]

Total 2011 Foreclosure Filings Reach 2.7 Million – Expect 2012 To Be Worse

Fed Chairman Ben Bernanke must be talking to himself by now. Despite driving interest rates to zero and the expenditure of trillions of dollars to prop up the housing market, home prices declined again in 2011. The most recent data on foreclosure activity makes it clear that the Fed’s efforts to date have accomplished next […]

Banking News – Daily Banking Update

Welcome to Banking Update, a roundup of articles and news from around the internet. The Federal Reserve’s political moves threaten its independence, loan modification companies prey on vulnerable homeowners, the big banks refuse to disclose their risk on derivatives, consumers want to be bailed out for foolish financial decisions, loss of confidence in governments grow […]

Banking News – Daily Banking Update

Welcome to Banking Update, a roundup of articles and news from around the Internet. Banks continue to be sued for selling defective mortgages, the Fed says a housing recovery is essential for economic recovery, Americans still believe owning a home is part of the “American dream”, banks are still engaged in risky behavior, savings rates […]