October 13, 2010 – Can the economy improve without a recovery in real estate values? This question was addressed today by FDIC Chairman Sheila Bair, in a speech to the Urban Land Institute in Washington, D.C. Despite optimistic forecasts by various analysts, Ms. Bair cited the daunting challenges that must be overcome in order to […]

FDIC’s Bair Says Real Estate Crucial To Entire Economy – $3.5 Trillion In Mortgages At Risk Of Default

Government Requests Banks To Buyback $30 Billion Of Defaulted Mortgages

September 15, 2010 – Defaulted mortgage loans sold to Fannie Mae and Freddie Mac during the peak years of the mortgage boom are now resulting in billion dollar losses for some of the largest banks in the country. Fannie Mae and Freddie Mac, now under the conservatorship of the Federal Housing Finance Agency (FHFA), are […]

Future Banking Industry Losses On Bad Loans Estimated At $268 Billion

September 14, 2010 – Despite the fact that banks have already taken huge losses on bad loans, Moody’s Investor Service estimates that the US banking industry still needs to recognize an additional $268 billion in losses on defaulted loans. According to Moody’s, banks will write off a total of $744 billion in bad loans through […]

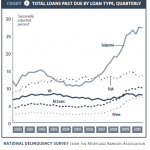

Delinquency Report Suggests Future Increase In Mortgage Defaults

August 28, 2010 – The newly released Delinquencies and Foreclosure report by the Mortgage Bankers Association (MBA) largely mirrors the Federal Reserve Bank of New York’s quarterly report on household debt and credit. The mortgage delinquency rate for one to four unit residential properties decreased slightly to 9.85% and the percentage of loans in foreclosure […]