Almost daily the mainstream news media is proclaiming that the housing crisis is over. A recent Wall Street Journal front page article boldly proclaimed “The Housing Bust Is Over.” No less an authority than Warren Buffett has suggested that housing has become a compelling investment opportunity. Tops and bottoms in any market are not usually […]

Low Interest Rates Have Impoverished Savers While Enriching Large Corporations

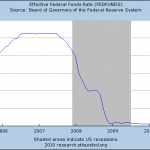

Every bank depositor is painfully aware that the effective real return on savings, after taxes and inflation is now negative. The bad news is that this situation is unlikely to change. Recent comments from the Federal Reserve indicate that they intend to keep interest rates at historically low levels for an extended period of time. […]

Banks Were The Worst Place To Keep Your Savings This Year

Federal Reserve Chairman Ben Bernanke warned us repeatedly that he would repress interest rates indefinitely in order to help the economy and the housing market. Interest rates on government treasury securities have reached all time lows and bank depositors are receiving close to a zero return on their savings. Meanwhile, both housing and the economy […]

Interest Rates At All Time Lows And Home Prices At Ten Year Lows – Why Are Home Sales The Worst Ever?

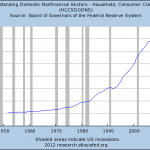

In Federal Reserve Chairman Ben Bernanke’s world, all he had to do was lower interest rates enough and housing prices would magically re-inflate. Wrong! Mortgage rates are at all time lows, home prices are at 2002 levels and owning a home is just as cheap as renting, yet the housing market remains mired in a […]

Five Year Treasury Notes Zoom Ahead Of Bank CD Rates

Longer term CD rates have been gradually climbing since last December as the long end of the yield curve has moved up. Abused savers, who have seen yields plunge to microscopic levels due to the Federal Reserve’s zero interest rate policy (ZIRP) are justifiably hoping to see an increase in interest income from savings. The […]

Tougher Standards By Banks For Mortgage Approval Requires Credit Education

November 18, 2010 – Several years ago, the mortgage underwriting standards of banks were so liberal that nearly anyone could get an approval, regardless of income levels or credit scores. The subsequent real estate crash and huge number of mortgage defaults since those easy lending days has resulted in much tougher underwriting standards. Many borrowers […]

Banks Win, Savers Lose As Fed Keeps Rates At “Exceptionally Low Levels”

June 23, 2010 – As expected, the Federal Reserve left interest rates unchanged at the end of a two day policy meeting. Citing financial turmoil in Europe and restrained economic growth at home, the Federal Open Market Committee (FOMC) voted to maintain the Fed funds rate near zero. The Fed funds rate has now been […]