December 22, 2010 – The latest FDIC Quarterly highlights the ongoing concern about the FDIC’s ability to protect depositors in the event of a large number of banking failures. Without the explicit backing of the FDIC by the US Treasury, the FDIC lacks the resources to adequately protect the $5.4 trillion in deposits that it […]

Six Problem Banks With $1.2 Billion In Assets Fail – Failed Banks For Year Total 157

The number of failed banks reached 157 as regulators closed six banks in Florida, Georgia, Arkansas and Minnesota. The six failed banks this week had a total of $1.2 billion in assets and resulted in a loss to the FDIC Deposit Insurance Fund of $267.6 million. The total loss to the depleted FDIC Deposit Insurance […]

First Arizona Savings of Arizona Fails – FDIC Finds No Buyer and Depositors Lose $6 Million

October 22, 2010- There are likely to be some shell shocked depositors tonight at First Arizona Savings, A FSB, Scottsdale, Arizona, who stand to lose $5.8 million in uninsured deposits. After the Office of Thrift Supervision closed First Arizona and appointed the FDIC as receiver, the FDIC was unable to find a buyer for failed […]

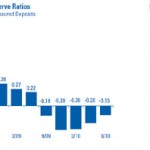

Restoration of Depleted FDIC Deposit Insurance Fund Could Take 10 Years

October 19, 2010 – The FDIC announced today a long term Restoration Plan to return the Deposit Insurance Fund (DIF) to a positive balance. The long term goal of the proposed fund management plan is to maintain a positive fund balance, even “during periods of large fund losses, and maintaining steady, predictable assessment rates throughout economic […]

Security Savings Bank, Olathe, Kansas, Shut Down By Feds

October 15, 2010 – Security Savings Bank, F.S.B., Olathe, Kansas, was closed by the Office of Thrift Supervision, which appointed the FDIC as receiver. The FDIC sold failed Security Savings Bank to Simmons First National Bank, Pine Bluff, Arkansas, which will assume all deposits and purchase all assets of the failed bank. Security Savings Bank, […]

Pace Of Bank Failures Increase As Regulators Close Six Banks

September 17, 2010 – After closing only one bank since August 20th, regulators picked up the pace and closed six banking institutions. With the recent increase in the number of banks on the FDIC’s “Problem Bank List“, regulators should be busy well into 2011 closing institutions that are considered “unsafe and unsound”. As of the […]

Maritime Savings Bank, West Allis, Wisconsin, Closed By Regulators

September 17, 2010 – Maritime Savings Bank, West Allis, Wisconsin, was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver. The FDIC sold failed Maritime Bank to North Shore Bank, FSB, Brookfield, Wisconsin, which will assume all the deposits but only about half of the failed bank’s assets. Maritime Savings […]