Large depositors of NOVA Bank, Berwyn, PA, are in a panic today after state regulators closed the failed bank. The FDIC, acting as receiver, was unable to find a buyer for NOVA Bank, and will pay off depositor accounts only up to the FDIC insurance limit of $250,000. NOVA Bank, established in 1887, had 13 […]

NOVA Bank, Berwyn, PA, Fails – Depositors Face Losses As FDIC Fails To Find Buyer

Regulators and Government Activism Are Prolonging The Housing Crisis

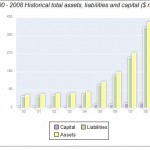

Banks never seem to learn as they lurch from one lending crisis to the next. In the early 1970’s the largest banks in the country lent recklessly to Latin American countries under the theory that sovereign nations would not default. The ensuing Latin American debt crisis and sovereign defaults shattered that complacent theory and many […]

Home Savings of America Collapses, FDIC Unable To Sell Bank – How Much Will Depositors Lose?

Home Savings of America, which was established during the depths of the Great Depression, was closed by regulators today. The Bank was established on September 1, 1934 and operated as a federally chartered stock savings and loan association, headquartered in Little Falls, Minnesota. According to Home Savings of America’s website, the Bank’s niche was serving […]

FDIC Sells Assets From 13 Failed Banks

In the past few years, regulators have found it necessary to close hundreds of insolvent banking institutions. The FDIC, acting as receiver for failed banks, is usually able to sell most of the assets of failed banks. Typically, the purchaser of a failed bank will acquire most or all of the assets of a […]

United Western Bank, Colorado, Closed By Regulators

January 21, 2010 – United Western Bank, Denver, Colorado, was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with First-Citizens Bank & Trust Company, Raleigh, North Carolina, to assume all deposits of the failed bank. United Western had 8 branches […]

FDIC Sells Failed Bank Assets For Pennies On The Dollar To Bank With Outstanding TARP Loans

December 22, 2010 – The FDIC closed on the sale of $279 million of assets from nine failed bank receiverships. The winning bidder of the asset pool was Cache Valley Bank, Logan, Utah, with a purchase price of 22.2% of the unpaid principal balance of $279 million. The failed bank assets will be placed into […]

FDIC Sells Mortgage Backed Bonds – Is A Taxpayer Bailout Next?

July 30, 2010 – The FDIC today raised $400 million by selling bonds backed by performing residential mortgages. The mortgages are part of $39 billion in assets acquired by the FDIC from failed banks (see FDIC’s Mountain Of Failed Bank Assets Grow). The securities are guaranteed by the FDIC and were sold at a coupon […]

FDIC Sells Failed Bank Loans At Steep Discount

Private Investors Make Very Leveraged Bet On Asset Value Recovery The FDIC currently holds approximately $30 billion in failed bank assets from banks that have failed in the past 18 months. The assets held by the FDIC were of such dubious quality that the FDIC was unable to entice acquiring banks to purchase them, despite […]