With interest rates at all time lows why wouldn’t banks love handing out home equity lines of credit (HELOC)? Since HELOCs are all written as adjustable rate second mortgages any increase in interest rates translates into instantly higher profits for banks. With a HELOC the borrower takes on interest rate risk as opposed to a […]

Counterfeit Cashier’s Checks Are Becoming a Major Problem

You just sold your car to what appeared to be a regular guy. After some back and forth negotiations the buyer agreed to accept what you considered a fair price. You sign over the title to the buyer, give him the keys, and the buyer gives you an official cashier’s check for the purchase price […]

Bank ATMs Are Easy Target for Criminals

As if banks didn’t have enough problems to worry about, a recent government report reveals that theft from ATM machine was become a widespread problem. The alarm bell on ATM fraud was sounded by an organization that most Americans have never heard of – the Federal Financial Institutions Examination Council (FFIEC) – which acts as […]

FHA Reverse Mortgage Losses Of $28 Billion – Profits For Banks, Disaster For Borrowers and Taxpayers

Reverse mortgages have become the new minefield in government sponsored mortgage lending. According to an independent estimate done for HUD, losses could exceed $28 billion through 2019. To put that figure into perspective, total losses to the FDIC Deposit Insurance Fund for the 51 banking failures of 2012 total only $2.5 billion. The good news […]

Tips On Saving and Managing Money For Young Adults – FDIC Consumer News

Why do so many people make mistakes in handling money? The foundation to wealth rests upon sound principles for borrowing, saving and investing yet many Americans lack the fundamental knowledge necessary to accomplish their goals. According to the State of Working America, the median wealth for white households is only $97,000 and for black households […]

Mortgage Borrowers Pay Thousands In Excess Fees Due To Complex Bank Pricing

Few people wonder if they got the best price on that newly purchased 65” HDTV. Transparency in retail pricing through technological advances has enabled consumers to quickly locate the retailer selling a product at the lowest cost. A few quick clicks on the web or the use of price comparisons apps such as Amazon’s “Price […]

Banks Are Powerless Against The Biggest Threat To The Financial System

Just when it appears that the banking system is beginning to stabilize, a new ominous threat to financial stability has become a serious concern among the nation’s top bankers. In a speech at a Berlin conference, Dennis Lockhart, President of the Federal Reserve Bank of Atlanta, talked about the serious threat of cyber attacks against […]

Banks Tell 30 Million Troubled Customers To Get Lost – One In Three Consumers Now “Unbanked”

How does the average consumer get by without a basic checking account? How does someone without a checking account pay the bills that arrive each month – drive around to each creditor and pay in cash? Where do you keep your savings – under the mattress or buried in the back yard? As incredible as […]

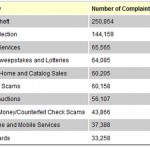

Counterfeit Checks Among Top Ten Consumer Complaints To FTC

That official looking bank check you receive in return for the sale of goods or services might actually be worthless. The con men and criminals producing counterfeit bank checks has prompted the FDIC to issue numerous warnings about specific banks that have reported counterfeit checks drawn in their name. The FDIC has noticed explosive growth […]

FDIC Warns About Withdrawn Deposit Insurance Scam

January 12, 2011 – The FDIC reported today that they received numerous reports from consumers who had received emails allegedly sent to them by the FDIC. The email attempts to solicit sensitive personal financial information from the recipient by claiming that FDIC insurance on their deposit accounts had been withdrawn. The email is a scam […]