August 19, 2010 – After another bad jobs report, President Obama called for an increase in lending to small businesses. According to the President, “Small businesses and community banks that loan to small businesses have been lagging behind. If we want this economy to create more jobs more quickly, we need to help them.” The President’s emphasis on the importance of small businesses is warranted. According to the Labor Department, small businesses with fewer than 50 employees account for 29% of all workers.

Since small businesses have traditionally accounted for the bulk of job creation, tight credit conditions would normally imply reduced job creation. The dynamics of the current downturn, unprecedented in modern times, suggest that increased borrowing will not be a panacea for economic recovery as has been the case in the past. An examination of the situation reveals that banks have ample funds to lend but many creditworthy small businesses have no need to borrow in a weak economy and reduced demand for their products. How do you force a company to borrow that has no reason to and what would be the benefit?

Some surveys regarding credit availability to small business firms do not provide a clear answer as to whether credit needs are being met, as noted recently in the Wall Street Journal.

Surveys of small-business owners offer mixed signals about the effects of tight credit conditions. The National Small Business Association found in a survey released last month that four out of five small-business owners reported that their company “has been impacted by the credit crunch.” That matched the high reached in July 2009, up from 55% in February 2008.

The latest survey by the National Federation of Independent Business, a separate trade group, last month found 91% of small-business owners reporting that their credit needs were met or they did not want to borrow, while only 4% cited financing as their top business problem. Uncertainty about the economy held back far more firms from investing: The percentage of business owners planning to make capital expenditures in the next few months fell one point to 18%, two percentage points above the 35-year record low. Only 5% said right now is a good time to expand facilities.

The Federal Reserve’s most recent survey of lending conditions indicates that credit needs are being met or that businesses have no current need or desire to borrow. The Fed report states that “In particular, around one-fifth of large domestic banks reported having eased lending standards for small firms, which offset a net tightening of standards by a small fraction of other banks. On balance, demand for C&I loans from large and middle-market firms and from small firms changed little in the July survey. In the April survey, banks had reported weaker demand from firms of all sizes.”

The credit needs of small businesses are being satisfied by the banks. Reduced levels of lending are due more to a lack of demand for credit and a reduced number of creditworthy borrowers. Creditworthy borrows will not borrow unless there is an increased demand for their products that will justify an adequate rate of return on the additional borrowings.

The Fed Lending Survey cites competition among lenders to make loans to qualified borrowers. In addition, the banking system has over $1 trillion in idle reserves allowing banks to easily make loans to qualified customers. The problem is not tight credit but rather a lack of loan demand by creditworthy customers.

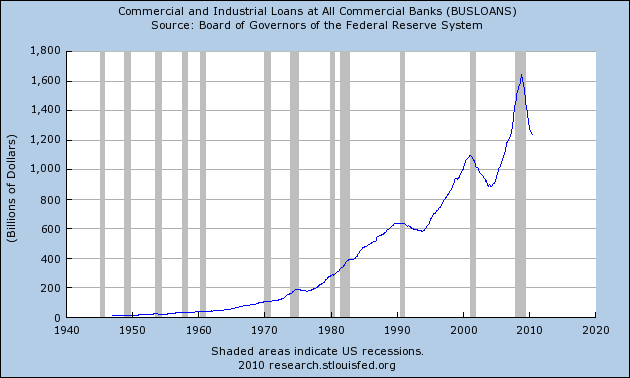

In the aggregate the commercial and industrial loan book of banks has declined as banks write off nonperforming loans and curb previously ultra loose lending policies. The decline in lending is a healthy correction after an unsustainable increase since 2005. Neither the Federal Reserve nor the President can force businesses to borrow, regardless of rates, until there is a rational business reason for doing so – and that day has not yet arrived.

Speak Your Mind

You must be logged in to post a comment.