Banking Industry – Recovery or Another Bailout?

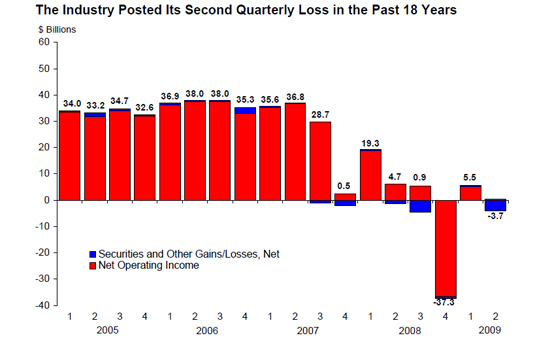

The latest FDIC Quarterly Banking Profile shows a banking industry still in turmoil, as non performing loans reached all time highs. The banking industry reported an aggregate net loss of $3.7 billion in the latest quarter ending June 30, 2009 compared to a year ago quarterly profit of $4.7 billion. (Please see FDIC 2009 Second Quarter Banking Profile for further details on second quarter results.)

The following charts from the FDIC provide a graphic insight into the banking industry’s current status. Profit performance of the banking industry is a lagging indicator and the difficult process of restoring balance sheets will take years. The banking industry still faces many difficult issues but the collapse we witnessed during 2008 has been contained and the latest FDIC Quarterly Banking Profile does show some areas of banking industry improvement.

Banking Profits

The banking industry has a long ways to go before profits recovery to the levels they were at before the banking crisis. The good news is that things have improved since the disastrous 2008 fourth quarter results.

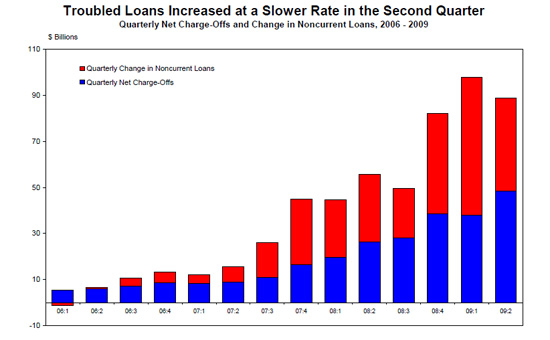

Troubled Loans

Loan writeoffs and noncurrent loans continue to be a major problem for the banking industry.

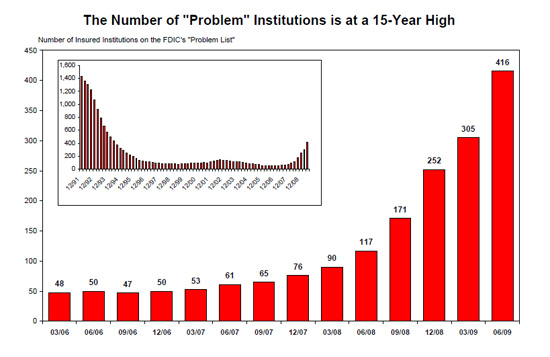

Problem Banks

Problem Banks continue to increase but are well below levels of the last banking crisis . Expect the number of banking failures to continue to increase in 2009 since many of these problem banks cannot raise additional capital.

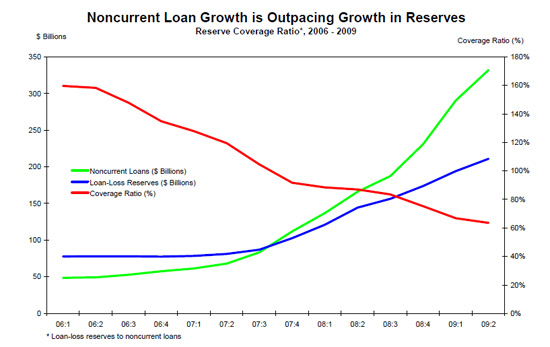

Noncurrent Loan Growth

The growth of noncurrent loans has far outpaced the growth in loan loss reserves. Banks will need to continue to increase loss provisions . The amount of noncurrent loans is at the highest level in recorded banking history.

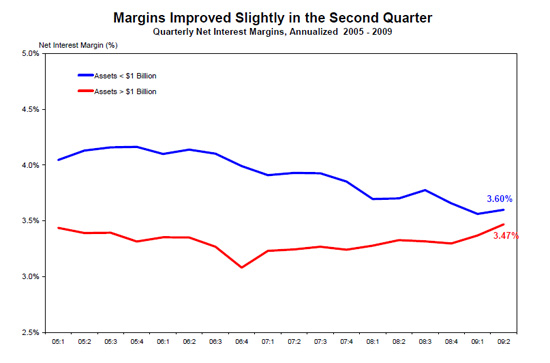

Banking Margins

A slight improvement in banking margins will help improve banking profits. The benefit to the banks come at the cost to savers who are receiving interest rates barely above zero.

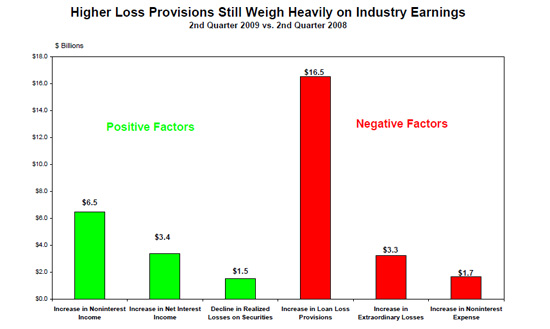

Loan Loss Provisions

Continued deterioration in loan quality has resulted in major losses to the banking industry. In the latest quarter ending June 30, 2009 loan losses cost the banking industry $67 billion. Expect this major negative impact on banking profits to continue since loan defaults on retail and commercial loans are increasing significantly.

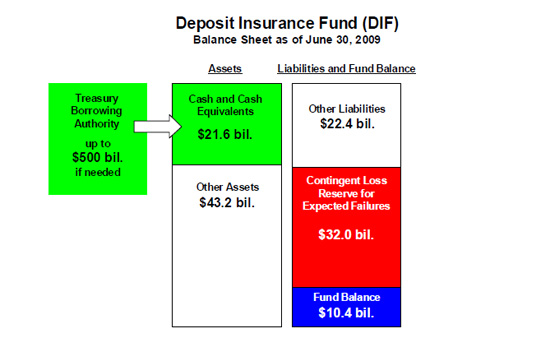

Deposit Insurance Fund (DIF)

The FDIC has set aside $32 billion for future banking failures and has a fund balance of $10.4 billion in the DIF fund. In addition, the FDIC has $22 billion in cash and authority to borrow as much as $500 billion from the US Treasury . If the FDIC ever needs to borrow a half a trillion dollars from the US Treasury we would be looking at a banking crisis that would make 2008 seem like a minor event. The FDIC’s relatively small amount of resources of $48 billion insures almost $5 trillion dollars in bank deposits.

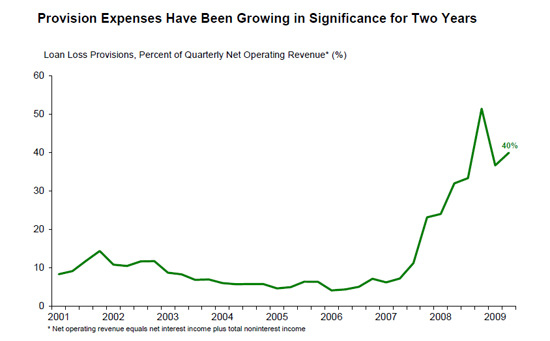

Loss Provisions/Revenue

The huge increase in nonperforming loans has resulted in the need to substantially increase loss provisions. The only good news here is that loss provisions have declined from last year’s peak levels.

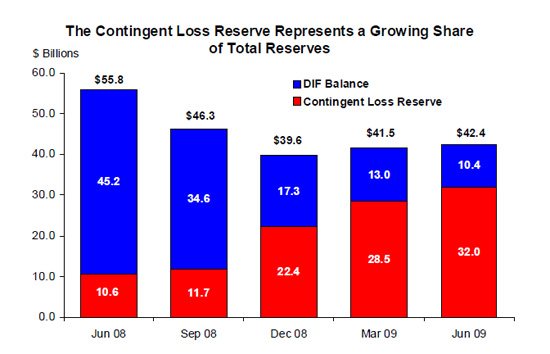

Contingent Loss Reserves

Contingent loss reserves represents FDIC reserves set aside for future banking failures. These reserves have already been deducted from the DIF balance. Total reserves are over $42 billion. The adequacy of the loss reserve is reviewed quarterly by the FDIC. Whether or not this amount will be adequate to cover future banking failures remains to be seen.

will wells Fargo bank fail i have a lot of money in this bank what should i do. thank for your reply. iam in the process pulling all of out in cash what do you think