The goal of the Volcker Rule, which became law under the Dodd-Frank Act was to restrict speculative trading activity in risky derivatives by the Too Big To Fail Banks. The ban on proprietary bank trading was proposed by former Federal Reserve Chairman Paul Volcker who believed that one of the primary causes of the 2008 financial meltdown was a result of speculative trading activity by banks.

Volcker argued that the use of depositor money back by FDIC deposit insurance to engage in risky speculation created systemic risk to the U.S. financial system. In addition, Volcker said that banks holding massive positions in derivatives to allegedly control risk were, in fact, creating even greater risk to the financial system.

Under the Dodd-Frank Act, the Volcker Rule’s provisions were scheduled to be implemented by July 21, 2012. During the two years since the Volcker Rule became law, regulators, bankers, legislators and lobbyists have been in a non stop battle over how the rule should be implemented and can’t even agree on what date the Volcker Rule regulations should become effective.

Meanwhile, the biggest banks in the country have built up massive speculative positions in derivatives. The Too Big To Fail Banks, by engaging in activities more suited to hedge funds and casinos, have added an element of instability and risk to the financial system that was supposed to be eliminated by the Volcker Rule.

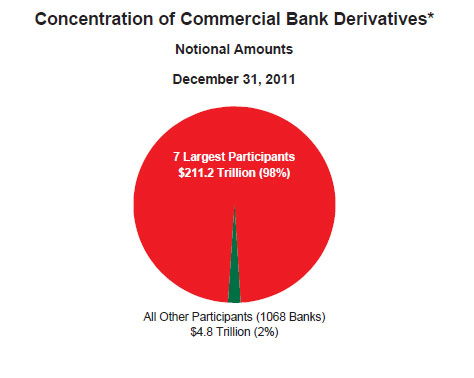

Evidence of the fact that the Too Big To Fail Banks have not taken the Volcker Rule seriously can be seen in the latest numbers published by the FDIC. As of December 31, 2011, the 7 largest banks in the country held an astonishing $211.2 trillion in derivative contracts. By way of comparison, the entire gross domestic product of the United States is only about $15 trillion.

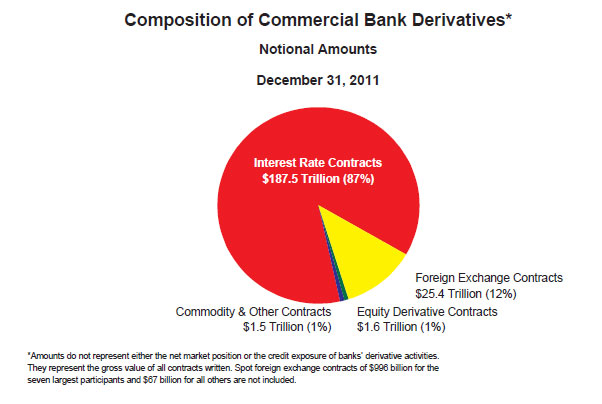

The composition of the $211.2 trillion of derivatives is primarily related to bets on interest rates.

Another reminder of the huge risks that banks are taking by making risky trades with FDIC insured deposits was the announcement by JP Morgan that $2 billion dollars was lost on speculative trading bets.

JP Morgan Chief Executive Officer Jamie Dimon said the firm suffered a $2 billion trading loss after an “egregious” failure in a unit managing risks, jeopardizing Wall Street banks’ efforts to loosen a federal ban on bets with their own money.

The firm’s chief investment office, run by Ina Drew, 55, took flawed positions on synthetic credit securities that remain volatile and may cost an additional $1 billion this quarter or next, Dimon told analysts yesterday. Losses mounted as JPMorgan tried to mitigate transactions designed to hedge credit exposure.

“There were many errors, sloppiness and bad judgment,” Dimon said as the company’s stock fell in extended trading. “These were grievous mistakes, they were self-inflicted.”

The chief investment office was thrust into the debate over U.S. efforts to ban proprietary trading when Bloomberg News reported last month that the unit had taken bets so big that JPMorgan, the largest and most profitable U.S. bank, probably couldn’t unwind them without losing money or roiling financial markets. Dimon, 56, had transformed the unit in recent years to make bigger and riskier speculative trades with the bank’s money, five former employees said.

Dimon had defended the unit as a “sophisticated” guardian of the bank’s funds on an April 13 conference call, calling news coverage “a complete tempest in a teapot.” On May 2, he led fellow Wall Street CEOs in a closed-door meeting to lobby the Federal Reserve about softening proposed U.S. reforms that might crimp their profits.

‘Egg on His Face’

Yesterday, he said the timing of the trading blunders “plays right into the hands of a bunch of pundits out there” who are pushing for a strict version of the proprietary trading ban named for former Federal Reserve Chairman Paul Volcker.

“It’s a major event that confirms a lot of investors’ worst fears about bank risk,” said Frank Partnoy, a former derivatives trader who’s now a law and finance professor at the University of San Diego. Concern is “that at a large, supposedly sophisticated institution, even something called a ‘hedge’ can contain all kinds of hidden risks that the senior people don’t understand.”

It is painfully obvious that the thousands of pages of laws and regulations of the Dodd-Frank Act have done little to reduce the size, complexity or systemic risk of the Too Big To Fail Banks.

In the count of derivatives in the Wall St banks are correct, the count that currently disturbs me the the $21 trillion in Sovereign debt. This combined with Cash swaps (CS’s) the Federal Reserve are holding is frightening short term. Merkel has reached the end of her reach and the Bundesbank will be very reluctant to cede rights to the ECB, based on German credit, to issue countless bonds for use in Greece and others who have Socialistic societies used to spending far more that they currently have and bleed Germany to death. A disorderly exit by any entity would greatly reduce the value of those CDS’s of which the banks are the Insurer.

AS for the rest of the derivatives, it is near impossible to try any valuation of risk. Interest only strips (tranches), Principal only Strips, Synthetic CDO’s and endless varieties of CDS’s become impossible to hedge in Net. WAGS (Wild Ass Guesses) using valiant econometric “Modeling” is attempted. But, as in the case of Synthetics there are so many non-model components that Configuring hedging formats are near impossible. I give great credit and admiration at the attempts our Econometric teams configuring models that E. Witten would be proud for purposes of valuation. It’s at best close with predicted volatility and out of control for off-model volatility. There needs to be separation from Consumer funds currently being used at 40-1 borrowing ratios to speculate. Crazy! Sandy Weill, (Genius who created two empires successful until he left), says break them up. I’ll go with sandy. Jamie Dimom, Smartest genius on Wall St. couldn’t control the whale’s trades. If Jamie can’t you can bet the others can’t.