The banking industry has made a dramatic recovery since the depths of the financial crisis when many of the country’s biggest banks survived only after receiving trillions of dollars in government support. After losing a record $37.8 billion during the fourth quarter of 2008, banking industry profits rebounded to a record high of $40.3 billion during the first quarter of 2013.

Although the banking industry is still earning profits comparable to levels reached prior to the banking crisis, profit growth has stalled out since the first quarter of 2013. According to the latest FDIC Quarterly Banking Profile (QBP), banking industry profits during the first quarter of 2014 totaled $37.2 billion, down by $3.1 billion or 7.6% from last year’s first quarter.

The first quarter of 2014 is only the second time in the past 19 quarters that earnings have declined on a year-over-year basis but both quarterly earnings declines have occurred during the last three quarters. Banking industry profits seem to have stalled out and the last four consecutive quarters have seen profits below the peak reached during the first quarter of 2013.

Banks are now facing major headwinds to future profit growth from a multitude of factors. The FDIC notes that “industry revenue has been affected by narrow margins, modest loan growth, and a decline in noninterest income as higher interest rates have reduced mortgage-related activity and trading income fell.” According to the Quarterly Banking Profile, adverse factors that are weighing on current and future earnings growth include the following:

Banks are now facing major headwinds to future profit growth from a multitude of factors. The FDIC notes that “industry revenue has been affected by narrow margins, modest loan growth, and a decline in noninterest income as higher interest rates have reduced mortgage-related activity and trading income fell.” According to the Quarterly Banking Profile, adverse factors that are weighing on current and future earnings growth include the following:

- Mortgage originations during the first quarter of 2014 collapsed from the previous year. Income from mortgage related activity plunged by 53.6% to $4.0 billion. Origination of real estate loans on one to four family residences were $323.6 billion for the quarter, down by 70.6% from the first quarter of 2013 due to rising mortgage rates and a sluggish housing market. The biggest hit to mortgage income was due to the dramatic decline in the number of people refinancing their mortgages. Refinancing, as a share of the total mortgage market, has dropped from 58% during April 2013 to only 37% in April of this year.

- Banking industry profits are being constrained by narrow lending margins. The average net interest margin (which is the spread between the cost of funding and the average yield earned on loans) was 3.17%, the lowest since the third quarter of 1989. Lower margins resulted in a decline from the previous year on the average return on assets from 1.12% to 1.01% and a decline in return on equity from 9.96% to 8.99% .

Despite the slowdown in profit growth, the FDIC cited some improvement in the condition of the banking industry due to the continuing improvement in asset quality, an uptrend in loan balances, fewer problem banks, and a higher percentage of profitable banks.

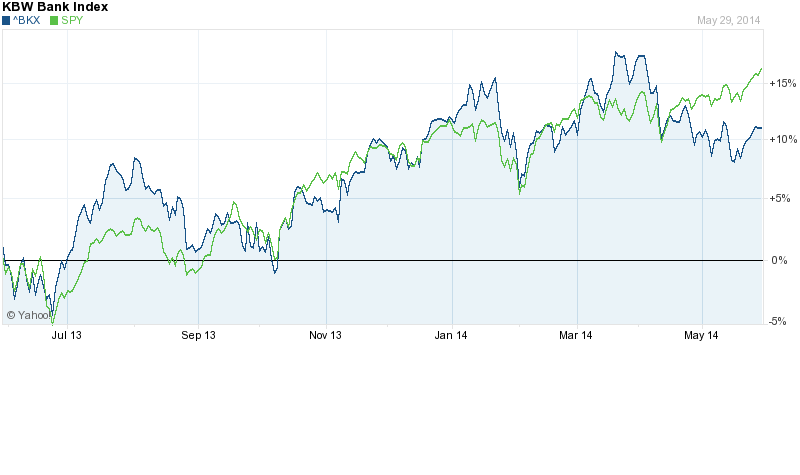

Banks have largely recovered from the dark days of the banking crisis as profits and capital positions improved tremendously over the past five years. Further progress in the banking sector from this point on will largely depend on expanding economic growth. The first quarter decline in GDP along with sluggish consumer income growth and a decline in banking profits seems to have given bank investors doubts about further recovery in the banking sector. After a strong rally during 2013, banking stocks (as measured by the KBW Bank Index) have recently lagged the performance of the Standard and Poor’s 500 and are likely to continue to do so until the profit outlook for the banking industry improves.

Speak Your Mind

You must be logged in to post a comment.