August 13, 2010 – Despite a nationwide drop in real estate values and all time high rates of mortgage defaults and foreclosures, 25 States have not had a banking failure in 2010. States that would seem to be obvious candidates for a large number of bank failures have actually experienced a small number of failures.

California, Nevada and Arizona, three States with very high rates of loan default and large property depreciation, have only had a total of 12 banking failures. As of August 6 there were a total of 109 banking failures in the US and Puerto Rico.

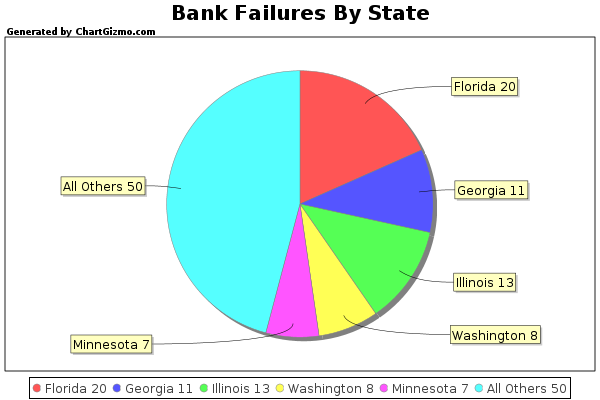

As of August 6, 2010, the five States with the greatest number of banking failures are Florida with 20, Illinois with 13, Georgia with 11, Washington with 8 and Minnesota with 7. These “top five” banking failure states account for 54% of 2010’s total banking failures.

Banking failures by State As Of August 6, 2010

| STATE/LOCATION | NUMBER OF FAILURES -2010 |

| ALABAMA | 1 |

| ARIZONA | 2 |

| CALIFORNIA | 6 |

| FLORIDA | 20 |

| GEORGIA | 11 |

| ILLINOIS | 13 |

| KANSAS | 1 |

| LOUISIANA | 1 |

| MASSACHUSETTS | 1 |

| MARYLAND | 3 |

| MICHIGAN | 4 |

| MINNESOTA | 7 |

| MISSOURI | 4 |

| MISSISSIPPI | 1 |

| NEBRASKA | 1 |

| NEW MEXICO | 2 |

| NEVADA | 4 |

| NEW YORK | 3 |

| OHIO | 1 |

| OKLAHOMA | 1 |

| OREGON | 3 |

| PUERTO RICO | 3 |

| SOUTH CAROLINA | 4 |

| TEXAS | 1 |

| UTAH | 3 |

| WASHINGTON | 8 |

| TOTAL | 109 |

Speak Your Mind

You must be logged in to post a comment.