Most shareholders understand that an investment in a public company entails risk – that’s what capitalism is all about. Well managed companies with great products generally wind up enriching shareholders over time and no one begrudges the fact that executives of a successful enterprise are well paid.

What a lot of shareholders don’t understand, however, is why executives of a public company are richly rewarded when a company’s performance is horrendous and the stock price crashes. Capitalism is supposed to reward success and punish failure – a theorem that should apply equally to both shareholders and company management.

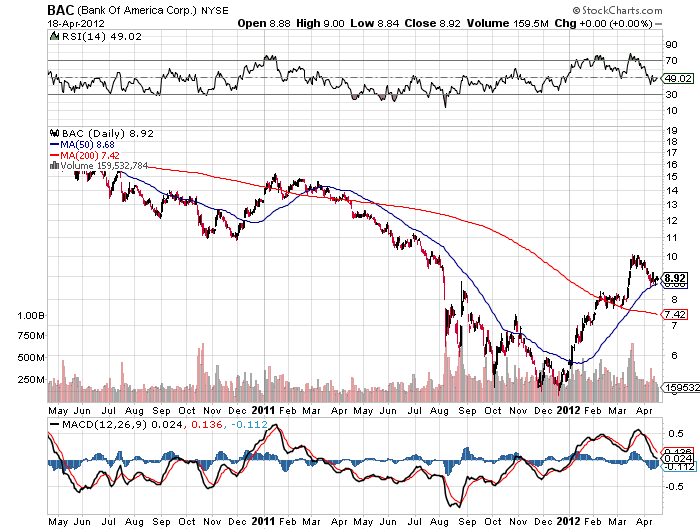

The relationships of risk vs. reward and management vs. shareholder were turned upside down by Bank of America during 2011 as seen in the two charts below. The top six executives at Bank of America took home a cool combined paycheck of $55.6 million during 2011 while shareholders suffered almost a 70% loss in the market value of their Bank of America shares during 2011.

Executives of Bank of America may face some tough questions at the Annual Meeting of Stockholders on May 9th.

Summary of Bank of America Executive Compensation 2011

Speak Your Mind

You must be logged in to post a comment.