August 19, 2010 – The latest Federal Reserve survey of bank lending practices showed a net modest easing in credit standards and terms in the second quarter. The slight loosening of credit standards, however, was not widespread. The Fed’s report noted that “While the survey results suggest that lending conditions are beginning to ease, the improvement to date has been concentrated at large domestic banks. Most banks reported that demand for business and consumer loans was about unchanged.”

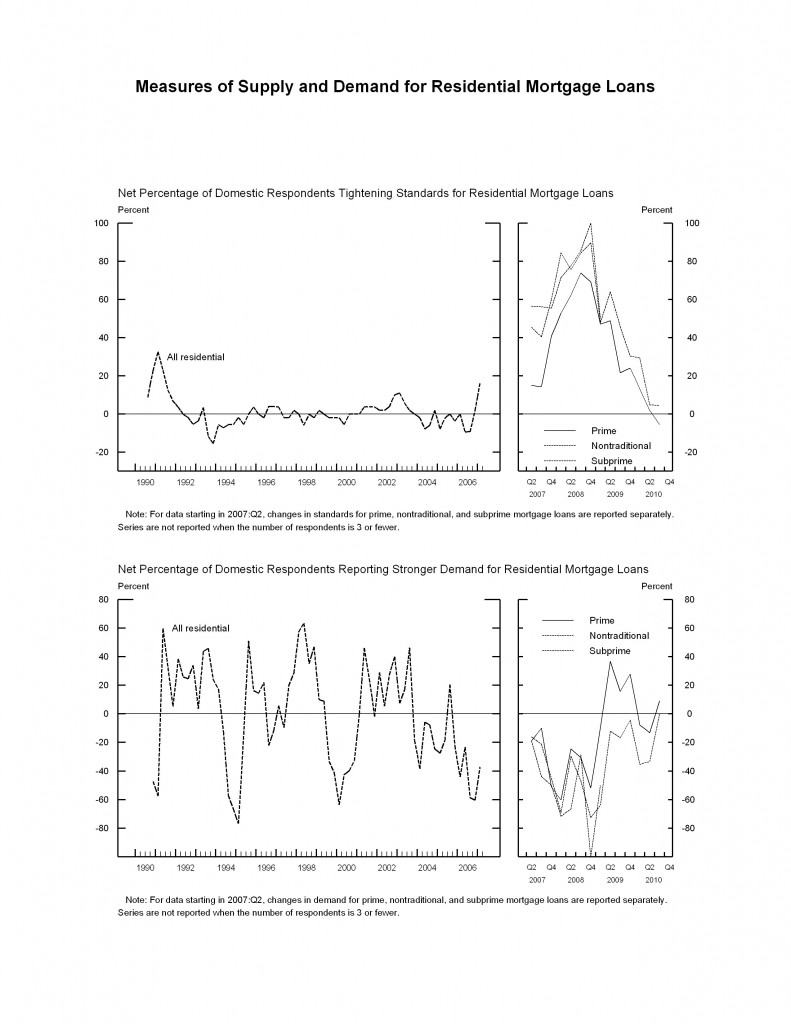

The vast majority of banks (87%) reported that their credit standards for residential mortgages remained essentially unchanged over the previous three months. Despite the ongoing dramatic decline in mortgage rates only 34% of banks reported moderately stronger demand for mortgages. Almost one third of banks reported a moderately or substantially weaker demand for mortgages.

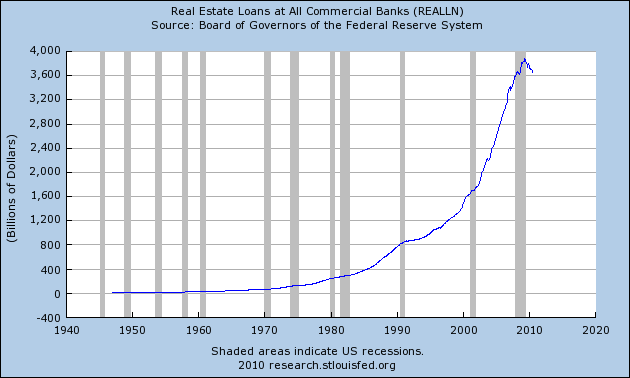

Demand for mortgages should remain weak into the foreseeable future as consumers struggle to service the huge amounts of mortgage debt already outstanding after the greatest credit boom in history. Many homeowners who took on excessive amounts of mortgage debt due to ultra easy bank lending standards are now defaulting in record numbers. Almost 10% of borrowers are 90 days or more past due on their mortgages. The number of homes repossessed in foreclosures increased to over 92,000 last month, a 6% increase from the previous year. The Federal Reserve Bank of St. Louis graphically shows the unsustainable increase in mortgage lending that has occurred over the past 20 years.

Real Estate Loans At Commercial Banks

In order for sound lending at banks to increase, a process of deleveraging must occur to reduce debt to manageable levels and allow economic growth from a sustainable base. The solution to excessive debt is not more debt which is why credit growth is weak. The average American consumer is spending less and saving more to rebuild lost wealth caused by weak income growth and home value depreciation. Without a substantial increase in incomes and economic growth, large increases in additional borrowing is both unwise and counterproductive.

Would not the refinance be a solution to many homeowners’ problems? Many homeowners are putting money in to lower their mortgage debt and refinance at these low rates. Cash out mortgages are forgotten. Cash-in mortgages are on the increase. That supports the message in this report.